Financial Planning & Coaching

Lifetime Financial Planning & Coaching

Everyone talks about how much money you need to retire and asks, ‘do you have enough?’

We expect our money to help us feel safe, especially as we grow older and have worked hard over decades to build up a nest egg.

Get in touch

Unfortunately, if you view your savings and investments only as numbers on a page that you are trying to nudge upwards, then there is no such thing as ‘enough’. You could always be saving more, investing more, spending less. But does doing so make you feel any happier?

We believe that the more important question is ‘Are you managing your money in a way that allows you to live the best life possible now and in your future?’

Let me ask you a question, ‘Does earning 1% less or more than the market impact how you live your life?’

Of course not. Yet, the majority focus on performance otherwise known as return on investment (ROI).

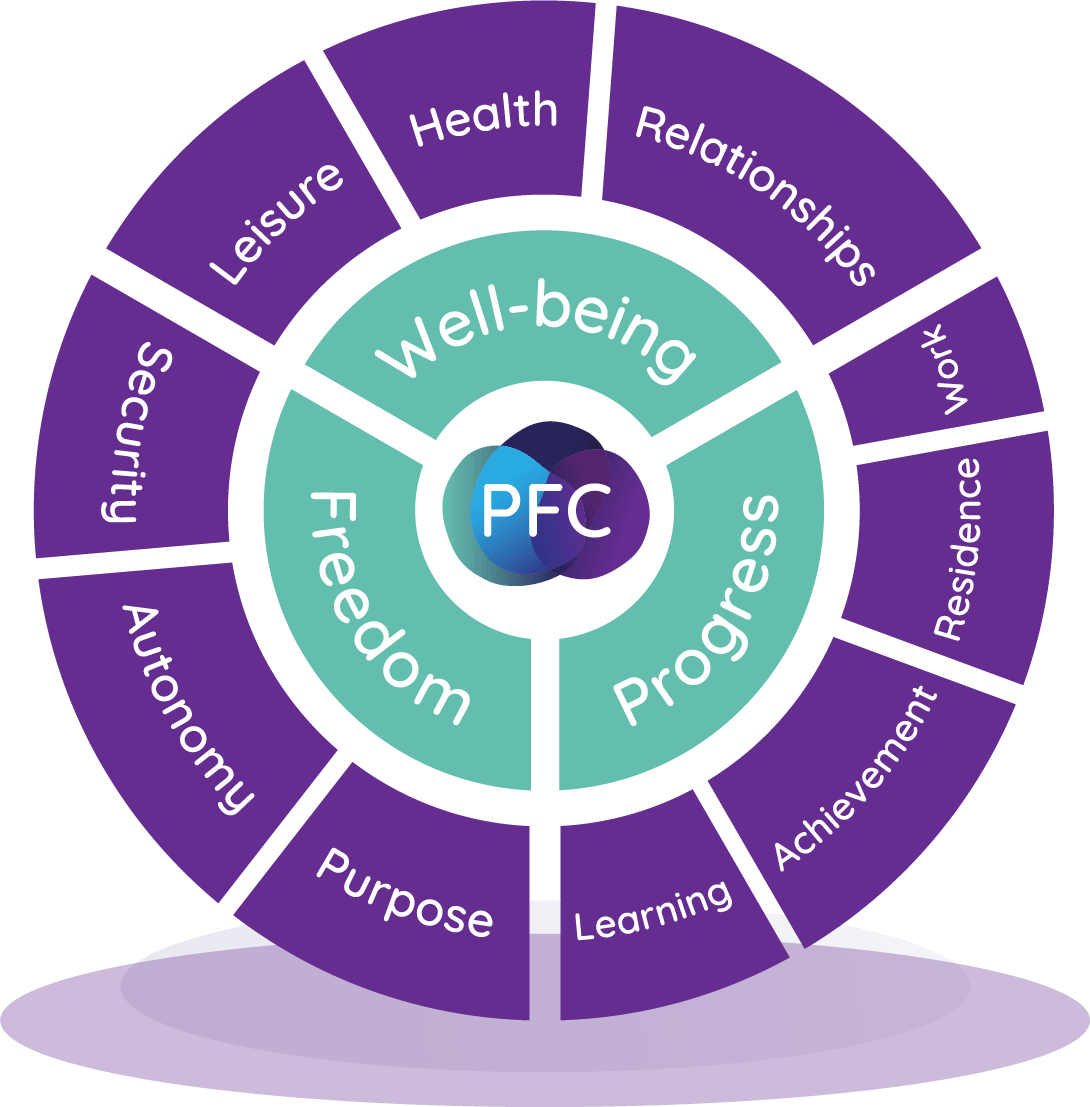

With our clients, we use a much more effective approach called Return on Life (ROL). The result of using this ROL-centred approach is that our clients are able to live the best lives possible given the money they have.

Return on Life

With ROL, you don’t give up the best of life just to get money. The money is there to serve you not vice versa.

Below we have gone into the details about the primary objectives of ROL planning.

Clarity about money’s purpose.

There is a point to having money. There is a purpose for gathering wealth. Yet the conversation about money’s purpose is grossly neglected.

It is all about moving from chasing money (hamster on the treadmill) to the meaningful pursuit of money by asking ‘What is the money for?’

The big money/life questions.

A plan designed with ROL as its foundation is designed to answer the three big money/life questions:

- How did I arrive at my perspectives on money? How you think about money is just as important as how you manage it.

- Am I managing my money in a way that is improving my life? This enables you to better understand your present position and your progress with using money for the best life possible with what you currently have.

- Am I financially prepared for life’s big transitions? Money goes into motion when life goes into transition. Do you know what life’s big transitions are heading your way, and when they are likely to happen? Are you planning for these?

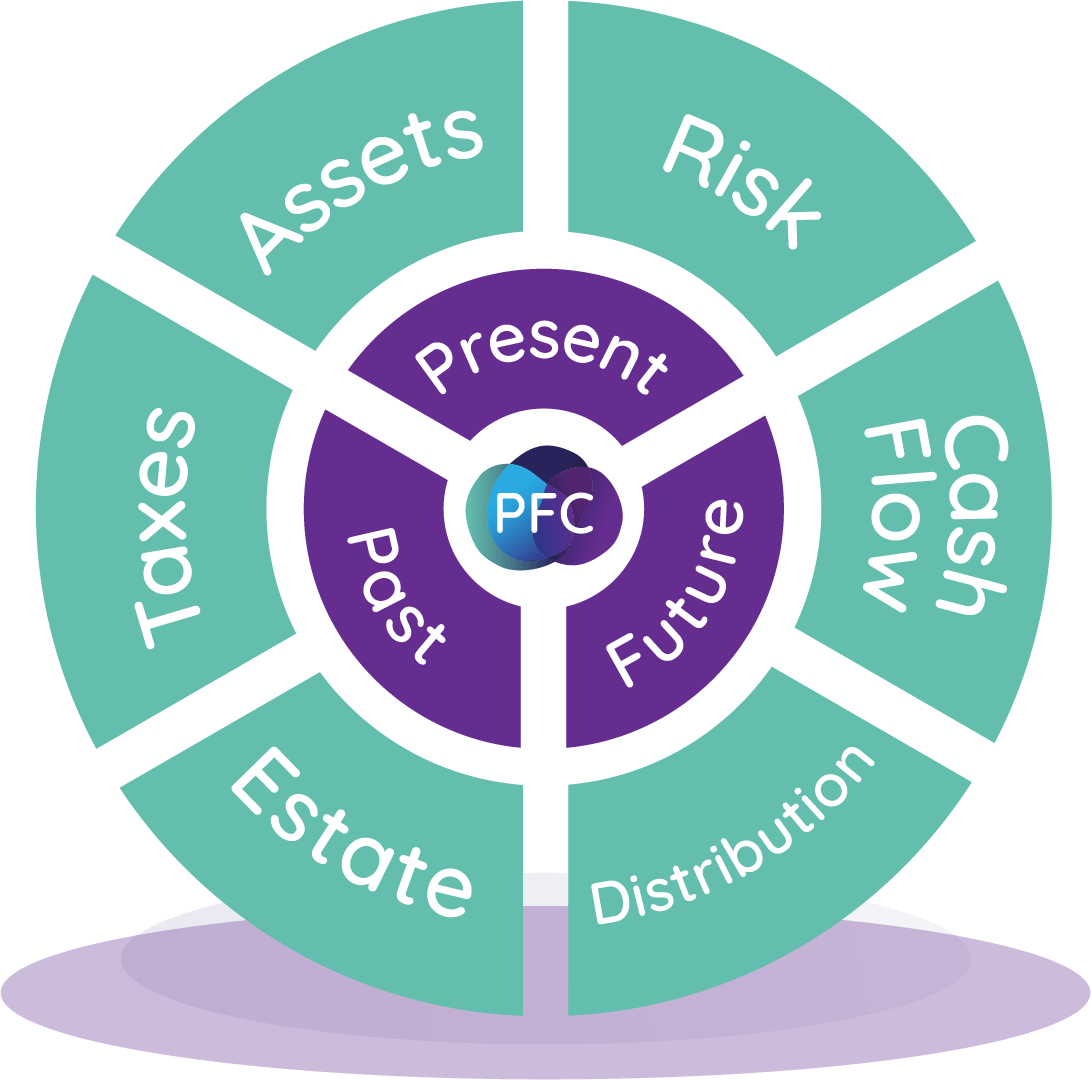

The financial plan.

Only after we have considered your Return of Life will we begin developing your financial plan. This financial plan should be a vehicle that takes you where you want to go. If you are fixated on ‘having enough money’ then your plan, and the life it provides you will be stuck in a cul-de-sac. You will find yourself trying to justify every minor and major financial decision as you circle around and around wondering if you ‘have enough’.

Return on Life planning is all about learning about how you can get the most out of your life

with whatever money you have or will have by allocating your resources (time and money) in a way that helps you get the best Return on Life.

1

Organisation

We will help bring order to your financial life.

2

Accountability

We will help you follow through on financial commitments

3

Objectivity

We will bring our insight from the outside to help you avoid emotionally driven decisions in important money matters

4

Proactivity

We will work with you to anticipate your life transitions and to be financially prepared for them.

5

Education

We will explore what specific knowledge will be needed to succeed in your situation.

6

Partnership

We will attempt to help you achieve the best life possible and will work in concert with you to make this possible.

01

Organisation

We will help bring order to your financial life.

02

Accountability

We will help you follow through on financial commitments

03

Objectivity

We will bring our insight from the outside to help you avoid emotionally driven decisions in important money matters

04

Proactivity

We will work with you to anticipate your life transitions and to be financially prepared for them.

05

Education

We will explore what specific knowledge will be needed to succeed in your situation.

06

Partnership

We will attempt to help you achieve the best life possible and will work in concert with you to make this possible.

Get in touch

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

Quick Links

0118 979 7596

mail@pfcthamesvalley.co.uk

Professional Financial Centre (Thames Valley) Ltd, authorised and regulated by the Financial Conduct Authority.

Registered in England 4261618. Registered office: Meadow Gate, Woods Farm, Easthampstead Road, Wokingham RG40 3AE

Quick Links

0118 979 7596

mail@pfcthamesvalley.co.uk

Professional Financial Centre (Thames Valley) Ltd, authorised and regulated by the Financial Conduct Authority.

Registered in England 4261618. Registered office: Merlin House, Brunel Road, Theale, RG7 4AB

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.

© 2024

Professional Financial Centre (Thames Valley) Limited

Cash management and financial planning services are unregulated